virginia hybrid tax credit

HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for. March 28 2013.

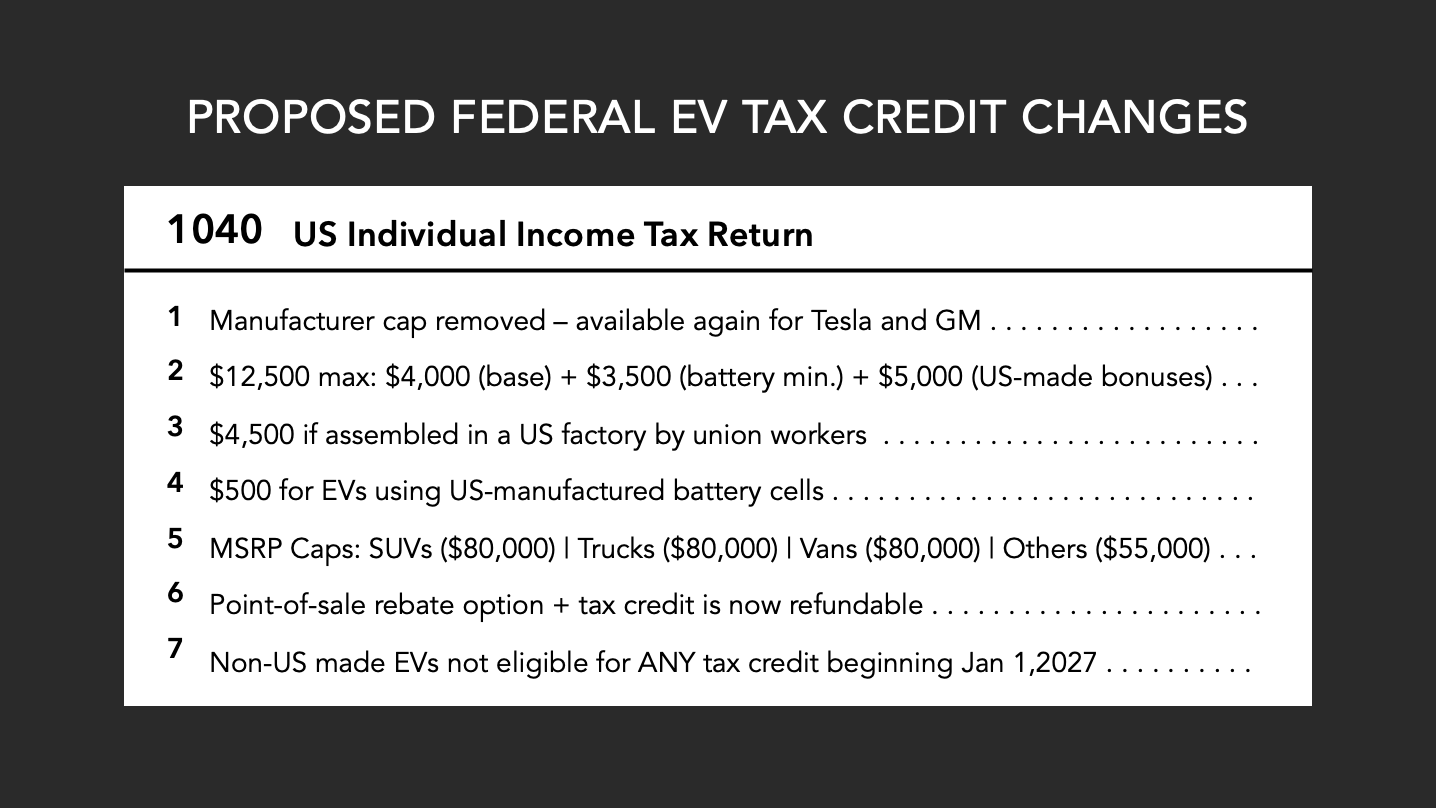

U S Senate Democrat Manchin Opposes 4 500 Ev Union Tax Credit Reuters

To entice American taxpayers to go green the government offers numerous federal tax.

. The Virginia Department of Mines Minerals and Energy must. If you take home a new PEV that meets. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV.

What You Need to Know About the 2022 One-Time Tax Rebate Starting in the fall eligible taxpayers will receive a one-time rebate of up to 250 for individuals and up to 500 for joint. The annual credit may not exceed 5000 and producers are only eligible for the credit for the first three years of production. The Governor has made his amendments to the transportation funding bill HB 2313 and if approved Virginia will soon have the nations only explicit hybrid.

Federal Tax Incentives for Buying a Fuel-Efficient Car. Review the credits below to see what you may be able to deduct from the tax you owe. Virginia offers a number of credits for individual income tax filers.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The PTC provides a corporate tax credit of 12 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and. The billHouse Bill No.

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. All credits have specific eligibility requirements and some require pre-approval or other certification. 469stipulates 10 percent of the purchase price or the whole cost of the lease term of an electric vehicle to be given to buyers as a tax credit but it.

Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Virginia. The goal is to reduce. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help. Review the credits below to see what you may be. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

The credit amount will vary based on the capacity of the. Your local Clean Cities coalition Virginia Clean Cities can. Refer to Virginia Code 581-2250 for specifics.

Ev Tax Credit Renewal And Expansion Gets First Big Push Under Biden Administration Cnet

Every Electric Vehicle Tax Credit Rebate Available By State

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Money For Electric Vehicle Rebates Appears Unlikely Virginia Mercury

How Manchin Kneecapped The Climate Bill S Ev Tax Credit E E News

How To Get Money For Evs And Charging Chargepoint

Electric Toyotas To Get Thousands Pricier As Ev Tax Credit Expires

Virginia State Tax Rebate Up To 3 500 For Electric Car Purchase Dies In Subcommittee

Virginia State And Federal Tax Credits For Electric Vehicles In Fredericksburg Va Pohanka Hyundai Of Fredericksburg

Us Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

2022 Electric Vehicle Tax Credits How Much How To Claim Phaseouts

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Irs Clean Energy Tax Credits Electric Vehicles Irc 30d

Most Electric Vehicles Won T Qualify For The Tax Credit That S In The Inflation Reduction Act Nbc Bay Area

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters